SBPey is an application for mobile phones with which you can pay using a QR code. In fact, this is a direct replacement for Apple Pay and Google Pay.

The main difference is that instead of holding your phone to the terminal, you need to scan a QR code. But it is not the only one, the difference also lies in the method of payment. MirPay, GooglePay, ApplePay and similar applications make payments via MIR, Visa and Mastercard. To pay, they need the details of a bank card linked to the application.

SBPey does not use bank card data. All payments are made from the bank account of the application user, and everyone who has a bank issued a card or opened a deposit has it.

The payment system can be used in retail stores, as well as pay for purchases of goods online.

The process of working with SBP

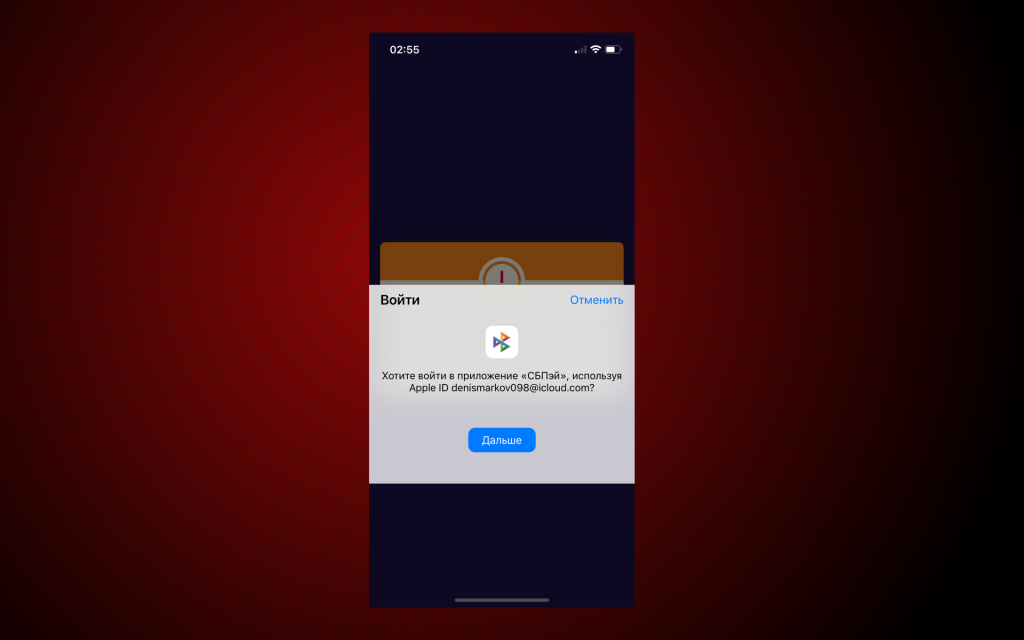

The corresponding application must be installed on the smartphone from Google Play and the App Store. The overwhelming number of negative reviews confuses the pages. Nevertheless, I think that over time the situation will improve. The application is less than a year old (it appeared last fall), and its functionality differs from Apple Pay and Google Pay, which can annoy the user at first.

But launching the application is very convenient. The system automatically prompts you to log in through the mail associated with iCloud. Just click the “Confirm” button and log in using Face ID. A couple of seconds and you’re done – you’re signed into the app.

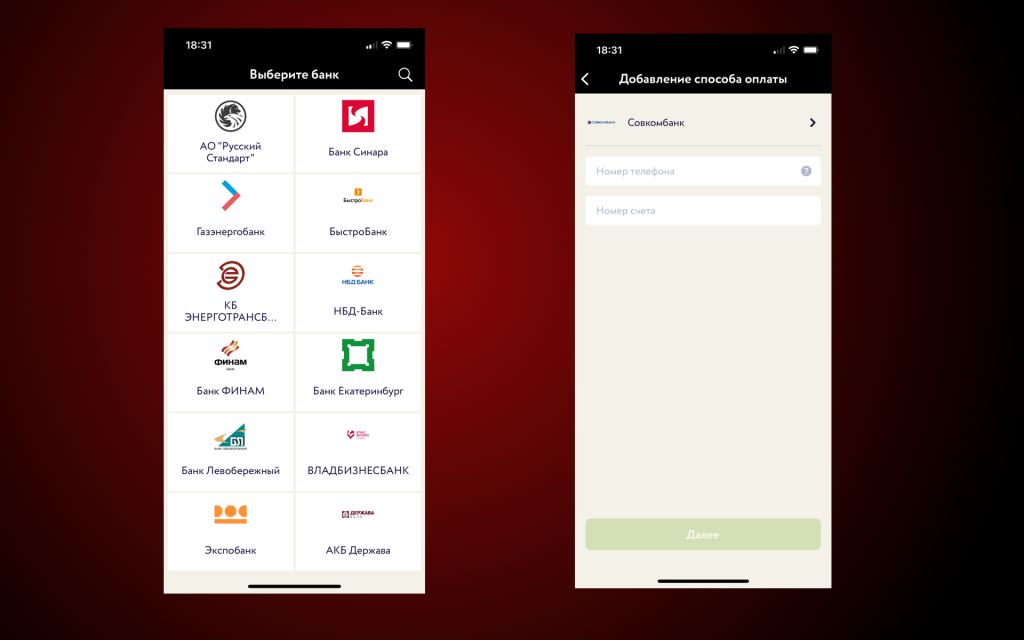

Next, you need to select a bank and indicate the account number in it. Recall that the system does not work with cards, all payments are made from the user’s bank account. And here is the problem: the most popular ones – Sberbank, Alfa and Tinkoff – are not here. Only little-known ones, like FINAM and Gazenergobank.

Fortunately, I have a Sovcombank card, and I linked the account with it. To see it, you need to open your own card in the application and see the details. If not, then you should get a card in one of the banks. Important: only a debit account can be linked to SBPey, not a credit account.

How to use it?

To pay for the goods, you need to scan the promotional code using the SBPey application. They are gradually introduced in large networks. Already, they are supported by three major brands:

- Wildberries

- L’Etoile

- Red & White

In other networks, I did not find QR codes. They are not, for example, in Magnolia, Pyaterochka and Perekrestok. That is, you still have to take a card with you, because it is not known whether it will be possible to pay contactless. I wouldn’t call it a downside. The service has been operating for about three months, stores and services have not had time to adapt to the new realities.

I tested the app in Red & White. Come to the checkout, they punch your order, say that you pay by QR code. Scan, the cashier counts the transfer. Ready.

This process seemed unreasonably long to me, unlike Apple Pay. There is no button to open this particular application on the smartphone, you need to perform three actions at once instead of one – open the application, select payment and point the camera at the QR code.

It seems easier to get the card and attach it to the terminal. Regarding it, there is only one convenience – you can not carry plastic with you and not be afraid to lose it, but the process lasts many times longer.

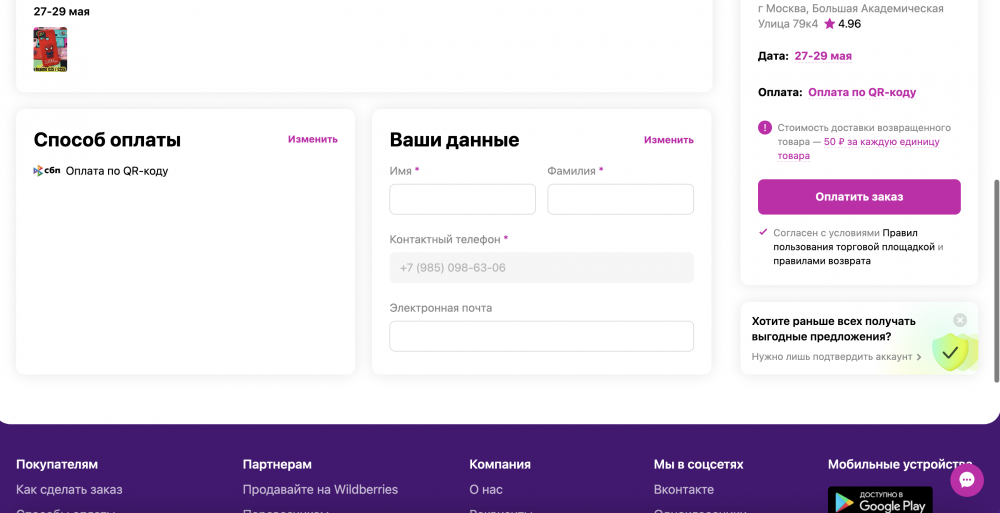

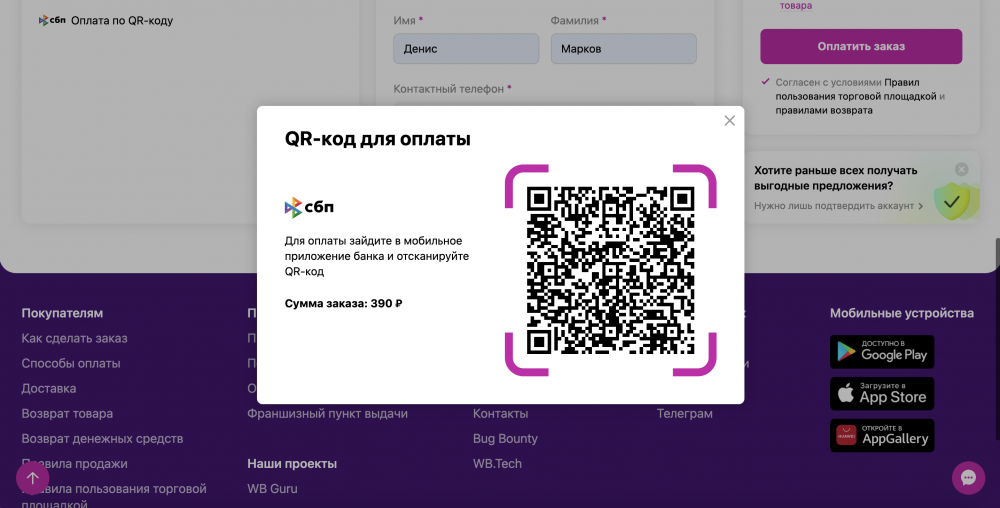

Websites have a similar process. In the PC version, specify the payment method “by QR code” and click “Pay”. A code will appear on the screen, scan it, and the payment goes through.

What if I don’t have cards from these banks?

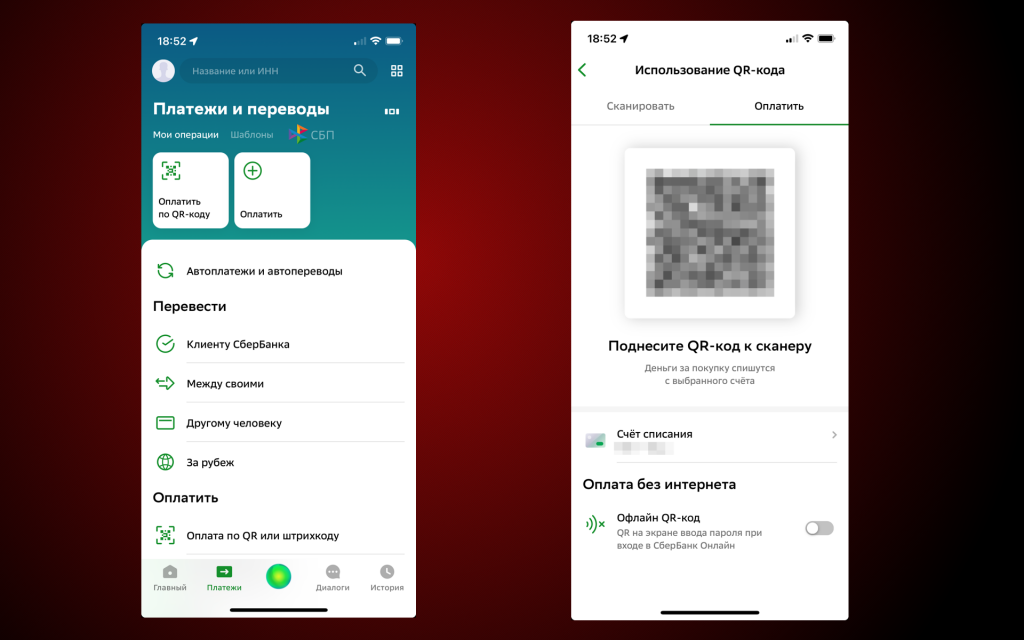

You can also pay using the QR code in mobile banking applications. For example, in Sberbank, you need to go to the “Payments” section and select the “QR-code” key.

The mechanics are the same – point at the QR code, and the system makes the payment. There are no differences at all.

On sites, in this case, you will need to link a map. Most services have the ability to save her data, after which you will need to enter a four-digit confirmation code to pay. The process is also longer than in the case of Apple Pay, but there is only one additional step – you do not need to open additional applications.

Outcome

SBPey seems to me a promising, but not yet ready-made development. The service has a chance to become a full-fledged alternative to Apple Pay and Google Pay, but this requires the support of all banks and store chains.

The state is working on its distribution. Central Bank already informedthat on July 1, all credit institutions must provide customers with the opportunity to use the service.

In terms of convenience, you can get used to anything, the only fact is that Apple Pay and Google Pay cannot be replaced in this part. It is too comfortable to pay for purchases with one touch of the phone.

However, with the right infrastructure, I will switch to QR codes instead of plastic. Cards are constantly lost and take up extra space in your pocket. It is convenient when a smartphone can perform their function. I look forward to when it becomes real again.

The post I tried SBP. Apple Pay and Google Pay replacement ready? appeared first on Gamingsym.