Focus on:

1. “According to many discussions, our company will now compensate you!”… Following the P2P thunderstorm, a new type of P2P payment scam is causing more and more P2P victims to fall into secondary harm.

2. According to the victim’s description, these scams are sophisticated, with a high success rate and large losses in each case. Those who were deceived included Kochi, pregnant women, and retired old men and women.

At the end of 2020, the China Banking and Insurance Regulatory Commission announced that the actual operating P2P online lending institutions across the country have gradually dropped from about 5,000 in the peak period, and have completely returned to zero.

However, a large number of P2P institutions were unable to make good payments due to suspected self-financing, fake bids and other issues, resulting in the inability of tens of thousands of P2P lenders to return their money. Although some P2P institutions have been filed for investigation, many P2P lenders are still eagerly waiting for their money back due to the long litigation process.

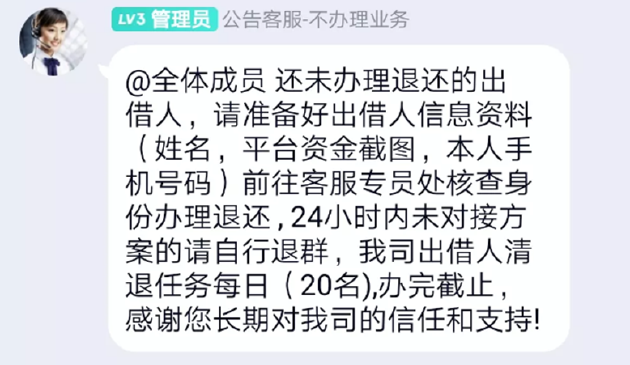

In the process, scammers also seized the opportunity. Since the beginning of this year, there has been a high incidence of fraud cases in the name of official P2P payment. Fraudsters lure P2P victims into the scam trap of paying first and then returning money through channels such as fake websites, emails, text messages, and social media accounts.

Many people have been cut leeks twice because of P2P.

Event 1: The pregnant woman was deceived for the second time and once wanted to commit suicide

Wang Xue (pseudonym) invested a principal of 110,000 yuan in P2P platform Piao Piaomiao in 2018, and reinvested again after making a profit of 30,000 yuan.

Among them, there are some funds from relatives and friends, she can only work hard to save money and repay it slowly. Although the P2P platform has been filed, there has been no official judgment and repayment news, and she gradually forgot about this sad event.

However, in January of this year, she was pregnant and encountered a new P2P scam, and the loss was even greater than before.

“I usually don’t use my mobile phone to check emails, but I logged in by some mysterious person that day.” She said that after logging in, an email with an official payment response happened to be sent. The email stated that the P2P organization has withdrawn from the operation. In order to recover the losses of the users, it will issue repayment compensation to the users in the official QQ group, and attach a group number.

“The wording of the email is very sincere, it is an apology, and it is a blessing for a happy life. I believe it as soon as my brain is hot.” After joining the group, the staff who claimed to be the official customer service said that the principal of the account must be injected before the principal can be unfrozen. , but after the injection of funds, the customer service also said that they have to pay taxes.

“I also thought for a moment that I was a liar who cut leeks, but I didn’t search online. I saw that every one in the group had withdrawn and returned the money, and I was moved.” Wang Xue said that the customer service kept asking for transfers. Under the circumstances, she finally realized that something was not normal, but it was too late. She had already transferred up to 220,000 yuan to the so-called official customer service.

After calling the police the next day, the liar even kept urging her to pay the thawing fee, and after scolding “the liar beats five thunders, you can’t die”, she angrily withdrew from the QQ group.

The 220,000 yuan was basically borrowed from multiple online loan platforms under the guidance of the swindlers, which made her even more vulnerable when she was pregnant and needed funds. “I couldn’t sleep for many days in a row, I would wake up after falling asleep for a while, and I thought about dying during this period.”

Now that the scam has passed for several months, she has gradually stepped out of the shadows with the help of her family. She said that the next step is to work hard, repay the loan well, and go ashore as soon as possible.

Event 2: Escaped the new scam, but the debt has reached 400,000

In February of this year, Lu Meng (pseudonym) also encountered a similar P2P payment scam.

She received a call from overseas at the time, claiming to be the official customer service of Digging Treasure, which she had invested in. The customer service said that now Duicaibao can fully refund the principal and interest to the lender, just add the QQ group to contact the administrator.

“I know this must be a scam, so I want to join the group to see how the scammers fool people, because my treasures were all paid out in 2018, and now there is not a penny in it. After joining the group, what did the administrator say to return the money? I need to advance funds before the payment, and I will not be fooled again.”

Although he escaped this new scam, at this time Lu Meng had not been able to get out of the previous P2P thunderstorm and was still burdened with huge debts.

Her unfortunate encounter came in 2020, when she had been working in the society for many years and had accumulated a certain amount of savings. She invested most of her savings in several P2P platforms, such as Renrendai and Duibao.

However, in October 2020, Renrendai encountered difficulties in redemption, and many lenders found that no funds were received after the target expired; in November 2020, Renrendai launched an emergency transfer channel without prior notice. Lenders who choose this channel get 30% off their principal and no interest at all.

At that time, Lu Meng saw the news of Renrendai’s explosion on the Internet. She was anxious to defend her rights and added a friend who claimed to be a Renrendai lender, but she did not expect that this friend who was also a Tianya Renren was a liar.

She invested nearly 300,000 yuan in Renrendai. This friend has always advised her to choose the emergency transfer channel as soon as possible. Even if the principal is discounted, at least she can get off from Renrendai. “Looking back now, he was waiting to cheat my money.”

Due to the large number of people queuing for the transfer, she finally failed to catch up with the 30% off transfer channel and could only withdraw at 65% off. This also means that she was reaped about 100,000 yuan by Renrendai.

And the scarier thing is yet to come. After withdrawing from Renrendai, that friend claimed to have a special way to make money and could lead her to recover her losses. With the mentality of being a victim, Lu Meng believed him and downloaded the installation package of the digital currency platform Starcoin that he sent.

Under his instigation, Lu Meng put the funds that he had just withdrawn from Renrendai into the platform, and later even went to the abyss of buying coins through online loans.

“I really wanted to recover Renrendai’s losses. At that time, I believed it, but the nightmare started.” Lu Meng said that in the end, not only did she lose all her savings, but she also borrowed from multiple online loan platforms for 26 years. He even borrowed 140,000 yuan from relatives and friends, and ended up with a debt of 400,000 yuan.

“After being deceived, I often have insomnia, and I dream about repaying the debt.” She said that some online loans have been overdue one after another, and she will receive calls for collection almost every day. Although the case was reported to the police, because the Starcoin server is overseas, it is difficult to recover the funds, and there has been no follow-up.

Now she has repaid the debt for more than a year, but she is still in debt of 170,000 yuan. The long-term psychological pressure has also caused her to suffer from depression.

“The days of being in debt are very difficult, and I am counting the days to get through it day by day. This year, I resisted the urge to quit my job 100 times, killed 1,000 times of suicidal thoughts, and made 10,000 fights against depression. You have to be strong, cheer up, and work hard to make money.”

Police: Judicial avenue is the only option for P2P refunds

In fact, scammers are not only using emails and phone calls to lure P2P lenders, they are also enticing victims to take the bait by sending text messages and posting fake payment announcements on social networking sites.

Sina Technology has found many false payment announcements in the name of Wanglibao, Shanghai Merchant Fortune, Hanjin Institute, Jujin Capital, etc. on social networking sites. The fraudsters posted a false statement of payment with the official seal, claiming that they cooperated with the state and relevant departments to make clearing and redemption work, and gave the clearing and withdrawal website.

This type of clearance website is very similar to the official website of the P2P platform, and P2P lenders who do not have a deep understanding of Internet technology are generally easy to be deceived. Such false clearing websites will post a notice of the lender’s refund and clearing, and ask to contact the online customer service for consultation.

After users click on the online customer service on the right, they will be asked to fill in information such as name, phone number, platform, and amount, and then fall into the trap of scammers step by step.

However, there are also many deceived P2P lenders who reported that they did not actively fill in the information on the Internet, but they still received calls, text messages and emails from the scammers, who suspected that their personal information was sold and leaked by the P2P platform.

This new type of P2P payment scam has also attracted official attention.

In January of this year, the China Banking and Insurance Regulatory Commission issued the “Risk Warning on Preventing Fraud in the Name of “Official Payment”. The reminder said that recent monitoring found that some websites, WeChat groups, QQ groups, and social media accounts pretended to be the name of the China Banking and Insurance Regulatory Commission. Fraud is a major risk. The China Banking and Insurance Regulatory Commission has not established or authorized the establishment of P2P online lending institutions’ collection channels. P2P online lending lenders are requested to be more vigilant and enhance their awareness of risk prevention and identification.

Similar warnings are being issued by police anti-fraud centers across the country.

The police of Beijing Daxing Anti-Fraud Center reminded that these scams are short-lived and sophisticated, with the characteristics of a high success rate of fraud and large losses in individual cases. “The victims of the money-back fraud include Kochi, executives, and retired old men and women. In order to get back their investment losses, they all chose to follow the instructions instead of verifying.”

The police said that some P2P platforms do have refunds, but they are all executed by the court after the court’s judgment takes effect. It is definitely not official to make claims by actively adding QQ and WeChat, and judicial channels are the only option.

However, generally speaking, the judgment process of the P2P platform explosion in the court is relatively long, which may be one of the reasons why fraudsters can take advantage of the fake payment announcement. To prevent such new P2P scams, it is necessary not only for P2P lenders to increase their awareness of prevention, but also for relevant departments to be more timely and transparent in P2P case information.

.

[related_posts_by_tax taxonomies=”post_tag”]

The post New trap!The money back scam was designed to “kill” the victims of P2P online loans… Develop Paper appeared first on Gamingsym.