In the digital world, banking applications were the first to suffer from sanctions. VTB24 and Otkritie customers were first removed from the App Store and Google Play stores, and then Sberbank was removed from significant ones. This scenario turns out to be a significant inconvenience for users of banking applications, since they can no longer be updated, and in the case of iOS, they will not be able to be installed on a new device. Provided that you did not use our guide and did not “mothball” for yourself a pack of important programs in reserve.

In this short note, I will try to look into the near future and try to understand what development paths await the applications of banks and services that have fallen under sanctions. To begin with, it is worth noting that Android users experience the least inconvenience with program locks. On the Google operating system, it is possible to install applications from third-party sources. In this way, banks can distribute APK files to their customers directly on their websites.

For example, on the same level, along with the App Store and Google Play, the Telegram messenger for Android is distributed through its official website. Moreover, it is in this scenario that users receive new versions faster than from the Apple and Google stores, since there is no moderator check by the platform holders. Sounds good, but what about on iOS?

There are now three paths for apps that have fallen out of favor with Apple and Google. Now we will try to model them.

Iranian way: the easiest

Recently, in a short note, we talked about what applications and services look like in Iran imposed by sanctions. There, as a bypass of various blockings, they chose the direction of web versions.

This is the easiest and most obvious way to develop. Some banks have already decided to reformat on the web. Why? Everything is simple. Any smartphone has a browser, it is enough to adapt the mobile bank page to the screens of mobile devices, transferring all the main functionality from applications there.

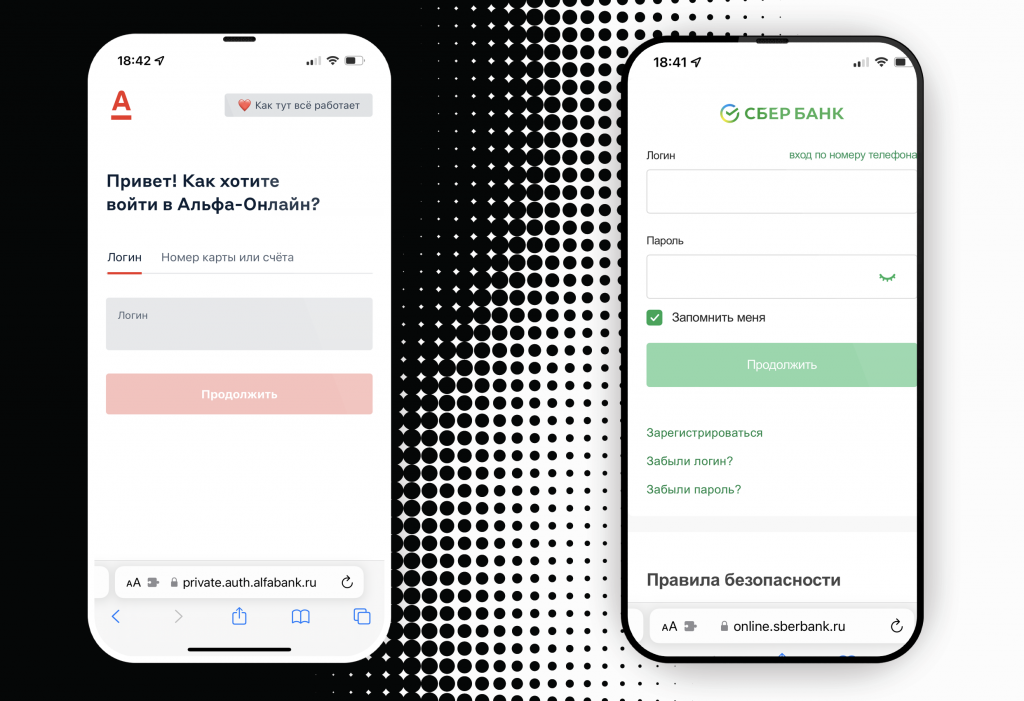

At first glance, it might seem that the web versions scenario is a win-win decoupling. Companies do not need to bother with the distribution of applications, but users with their search. I opened a page in Safari, entered my account information, passed two-factor authorization and you’re done. However, this method of interaction has a rather tangible disadvantage – security.

As banking and financial web versions develop, numerous phishing and fraudulent schemes will appear. You will have to carefully work out a secure authorization system and deal with clone sites.

Chinese way: the most convenient

Another most obvious way to develop banking applications and services is integration into the messenger. Here you can draw an analogy with the Chinese WeChat, which has become a full-fledged communication platform.

Essentially, WeChat is “Internet on the Internet”. He became the progenitor of the concept of superapps or so-called super applications. In short, WeChat replaces a bunch of programs for the Chinese. Conventionally, in this messenger you can communicate with friends and colleagues, there is also an integrated payment system using QR codes and a showcase of various services.

In Russia, something similar is trying to develop VK. In addition to communication and entertainment functions, the social network application also integrates the AliExpress marketplace, food delivery and scooter rental services, and has its own payment system. Theoretically, VK has every chance of becoming an analogue of WeChat for the Russian Federation.

However, if we talk about a functional and innovative super app, Telegram is worth considering. This month Pavel Durov’s messenger got major update with web bot support. What does this mean?

Bots in Telegram with the latest update have received a logical and evolutionary development. From simple helpers with modest functionality, they have turned into full-fledged mini-applications that run on JavaScript. Banks and services can use the new opportunity to build an ecosystem around Telegram.

What are the disadvantages of such a path? China managed to unify the platform and concentrate users on WeChat. In Russia, WhatsApp still holds the first place in terms of user base. However, the Russian audience of Telegram has grown significantly.

In my opinion, the concept with Telegram is the most comfortable. What do you think about this, do not forget to tell in the comments.

The Hardcore Path: You Probably Can’t Wait For It

The third perspective is the most hardcore. It consists of financing and investment in the jailbreak. Given the rather strong IT sector of our banking sector, the jailbreak scenario does not look like something fantastic.

Such a concept may be interesting for users, but at the same time, it risks turning into regular financial losses, since a jailbreak is an “armor and projectile problem”. With updates, Apple will close the discovered vulnerabilities, so there is a need to look for new ones.

So you end up

Installed applications of blocked banks will continue to work as long as they are supported by the operating system. It is obvious that in the next six months we will see the active development of web services. However, the Chinese path in the long term should not be discounted.

.

The post What awaits banking applications and services in Russia that are subject to sanctions? What are the prospects appeared first on Gamingsym.